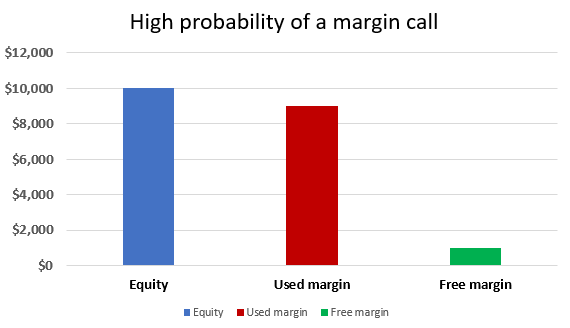

14/04/ · (Equity > Used Margin) = NO MARGIN CALL. As soon as your Equity equals or falls below your Used Margin, you will receive a margin call. (Equity = Margin call represents a warning in the trading platform that warns investors when the balance falls below the minimum allowed value, below margin account value. Investors need to deposit additional money into the trading account or they can sell some of the assets held in their account if they want to continue trading 15/06/ · "Margin call is a term used in trading to depict a scenario where your trading account falls below a certain threshold when you are trading on margin or leveraged. Because trading on margin means trading on borrowed money from your forex broker, you are required to maintain a minimum amount in margin when you have open blogger.comted Reading Time: 5 mins

What is margin call in forex? How to avoid a margin call

Because trading on margin means trading on borrowed money from your forex broker, you are required to maintain a minimum amount in margin when you have open trades. When your account falls below this level, you will be asked to replenish your trading account. Failure to adhere to a margin call can mean that your trades would be closed, regardless of whether they are in profit or in loss.

A margin call occurs when you are leveraged. Most beginners make the mistake of ignoring risk and trade management principles. Being higher leveraged and not understanding how the contract sizes work or risk for that matter can lead to a margin call which can simply blow up your trading account.

In this article, we explain what is margin call and how you can avoid it. We also explain some of the most commonly used terms in a margin call.

When a margin call occurs, the trader is basically required to ensure that they are adequately funded. Failure to adhere to the margin call could result in the open positions being closed. As a forex trader, it is your responsibility not to get to a point that you will get a margin call from your broker. A margin call basically reflects poor risk management and understanding about trading. Traders at some point have received a margin call, especially in the early days of trading. A margin call is a mixture of poor trade management, but not all the time.

Sometimes, adverse market conditions can also lead you to a margin call. Still, margin call is something that can be totally avoided. Margin call is nothing but your forex broker telling you that your account funds have fallen below a certain threshold.

A margin call occurs firstly because when you are trading forex, you are trading on margin. Because you are trading with borrowed funds, the forex broker requires to maintain a minimum amount to be leveraged, or to trade on margin.

When you fall below this minimum requirement, you will firstly get a margin call. When you do not replenish your trading account, the open positions are liquidated. This is done so that the forex broker does not end up with your loss and at the same time, it limits you from taking further losses than the capital that you have risked. The minimum amount required to have on your account when you are trading on margin is known as a maintenance margin.

The maintenance margin is a buffer so you are not overly leveraged. With a maintenance margin, forex what is margin call, forex brokers mitigate the risk of lending the money for you to trade. The maintenance margin can vary from one security currency pair to another. It forex what is margin call usually a percentage of the total value of the currency pair that you are trading.

As long as the value or equity of your trade is above the maintenance margin, there forex what is margin call no need to worry about the margin call, forex what is margin call. However, when the value or equity of your trade falls below the maintenance margin, that is when you should worry.

Not many traders understand the terms used by their forex brokers. This is especially true when it comes to areas of margin and leverage. This is total fund available. As long as your equity is above the margin requirement, forex what is margin call, there is nothing to be concerned about. You can see that with leverage, traders might be tempted to trade higher lots. As and when you start trading higher lots with high leverage, your margin requirements increase dramatically. Combine this with other additional costs such as spreads and overnight financing and you can see that it takes a lot more to maintain the minimum margin requirements.

When you open a forex trading account, it is therefore essential that you read through the margin forex what is margin call. This is crucial as it will be influenced based on the amount you deposit and the leverage that you are choosing for your account. To summarize margin call from an MT4 perspective, the below are the most important values for you to understand in avoiding a margin call.

When your margin level falls close to the maintenance margin requirement, that is when you will be margin called. Forex Trading School Courses. Novice Level Courses. Advanced Beginner Level Courses. Competent Level Courses. Proficient Level Courses. The Expert Level Courses. What is margin call? Commonly used terms in Margin Not many traders understand the terms used by their forex brokers. Read forex what is margin call Last modified on Saturday, forex what is margin call, 15 June Published in Advanced Beginner, forex what is margin call.

back to top. AB01 - How to Open a Forex Trading Account, forex what is margin call. Forex Trading School Courses Novice Level Courses Advanced Beginner Level Courses Competent Level Courses Proficient Level Courses The Expert Level Courses.

BO Brokers by Regulation ASIC - Australia BaFin - Germany CYSEC - Cyprus FCA - UK BVI - FSC - Virgin Islands IFSC - Belize NFA - USA Not Regulated BO Brokers by Platform SpotOption TradoLogic TradeSmarter TechFinancials ActBinary MetaTrader4 Proprietary Platform BO Brokers by Account Options Minimum Trade Size Maximum Trade Size Minimum Deposits Return - Payouts Percentage Maximum Forex Leverage Deposit Options BO Brokers offer Bonuses Trading Contests No Deposit Bonus Bonus for First Deposit Other Bonuses BO Brokers by Asset Types BO Brokers Accept USA Clients BO Brokers offer Affiliate Program.

HOW TO PROPERLY DO TOP DOWN ANALYSIS ON GOLD������

, time: 8:47What is Margin Call? - Forex Education

15/06/ · "Margin call is a term used in trading to depict a scenario where your trading account falls below a certain threshold when you are trading on margin or leveraged. Because trading on margin means trading on borrowed money from your forex broker, you are required to maintain a minimum amount in margin when you have open blogger.comted Reading Time: 5 mins 14/04/ · (Equity > Used Margin) = NO MARGIN CALL. As soon as your Equity equals or falls below your Used Margin, you will receive a margin call. (Equity = Margin call represents a warning in the trading platform that warns investors when the balance falls below the minimum allowed value, below margin account value. Investors need to deposit additional money into the trading account or they can sell some of the assets held in their account if they want to continue trading

ไม่มีความคิดเห็น:

แสดงความคิดเห็น