14/12/ · One of the most powerful yet often neglected techniques is trading on Forex correlation. This is especially important for traders who trade more than one currency pair or want to build a portfolio of trades, in which case Forex correlation can significantly boost profitability and reduce market blogger.comted Reading Time: 8 mins 25/02/ · MT4 MTF Correlation table and Correlation oscillator indicators replies. Correlation Between Trading Time and Technical Trading Success 1 reply. Correlation trading 90 replies. trading Eur/Gbp based on E/U x G/U correlation 9 replies. Correlation/Price Crossings Trading Tips? 3 replies 07/06/ · Why Understanding Forex Pair Correlations Is Important. A forex correlation is how one currency pair moves in relation to another. Some pairs move in a very similar way, others move in opposite directions and other pairs may have no relation to each other at all. If you take multiple currency positions at one time, knowing how your pairs act in Estimated Reading Time: 7 mins

How to Use Currency Correlation in Forex Trading - Forex Training Group

How To how important are correlation.forex, Tips. Correlations play a BIG role in trading, and in Forex trading especially. As Forex traders, we trade international currencies from different countries from all around the world.

Currencies are issued by central banks and are used for international trade, investing and to control economies. The value of a currency has a direct impact on an economy, the outlook for a country, how important are correlation.forex, commodities, stock markets and the spending behavior of people. At the same time, currencies are influenced by many different factors such as inflation, interest rates, employment and many more.

In this article, I will explain what correlations are, how to use them and which ones to pay attention to in particular. Together with technical analysis that we teach you in our private courseyou can build a powerful trading method, how important are correlation.forex.

Correlation describes whether two financial instruments currencies pairs, stocks, how important are correlation.forex, commodities, etc move in the same direction, into opposite directions or have no correlation and relationship. Positive correlation: When two pairs have a positive correlation, they move in the same direction.

Also, the USD and CAD often move very similarly. Negative correlation: When two currencies, are negatively correlated, they move in opposite directions. One mistake traders make is that they increase their risk by trading multiple pairs without knowing it. Thus, they tend to move in how important are correlation.forex same direction very similarly.

Forex pairs are almost always correlated and especially if you trade Forex pairs which have one identical currency in it, you need to know about correlations. So, most Forex pairs that have the USD as the second currency are positively correlated with some exception :. The same thing is true if pairs have the USD as the first currency; they are also positively correlated :, how important are correlation.forex.

Whenever Forex pairs have the currency at the same place, they are usually positively correlated, how important are correlation.forex. The below screenshot shows 4 different EUR Forex pairs and you can see how those often move in sync. You can then use this information for different purposes as we will see shortly. If you trade USD pairs, you need to keep track of the US Dollar Index. The US Dollar Index is a mix of different Forex pairs which include the USD and it shows the value of the USD against different currencies.

Knowing what the USD Index does can help traders understand how strong, or weak, the USD really is. If you know that the USD Index is strong at the moment, you can use that to trade high probability breakouts on other USD pairs.

Or you can stay out of trades if the USD is weak. Finally, knowing if the USD Index trades into important support and resistance areas can also help you make better trading decisions. Thus, it is critical to understand the correlations and which markets to follow for your Forex pairs.

Canada is a major oil producer and exporter and the Canadian economy highly depends on oil. Thus, the Canadian Dollar and the price of oil how important are correlation.forex to be positively correlated.

If you trade any CAD how important are correlation.forex, it always pays to understand what oil is doing. Australia is a significant gold producer and exporter and the Australien economy depends on Gold and the mining sector. Thus, we can often see that the price of gold and the AUD move together in the same direction. The second screenshot shows that even clearer. The Yen futures and gold often move in lockstep with very high correlation. The screenshot also shows the correlation to US Treasuries which is also positive.

When uncertainty is high, people buy Treasuries and the Yen. Because Forex pairs consist of 2 currencies, we can build, how important are correlation.forex, so called, Forex triads. This is how important are correlation.forex helpful if you want to understand currency strength. By looking at such a Forex triad, you can see which of the three is the strongest and weakest.

Also, whenever you have a Forex triad, there are usually 2 Forex pairs moving strongly while one ranges sideways. Thus, you can use Forex triads to make better trading decisions and pick Forex pairs in a professional way. You can read more about Forex triads here. You can see, correlations are a big part of Forex trading and whether you like it or not, correlations impact your trading at all times. This content is blocked. Accept cookies to view the content.

click to accept cookies. This website uses cookies to give you the best experience. Agree by clicking the 'Accept' button. The Most Important Forex Correlations And How To Use Them Home How To The Most Important Forex Correlations And How To Use Them. The Most Important Forex Correlations And How To Use Them.

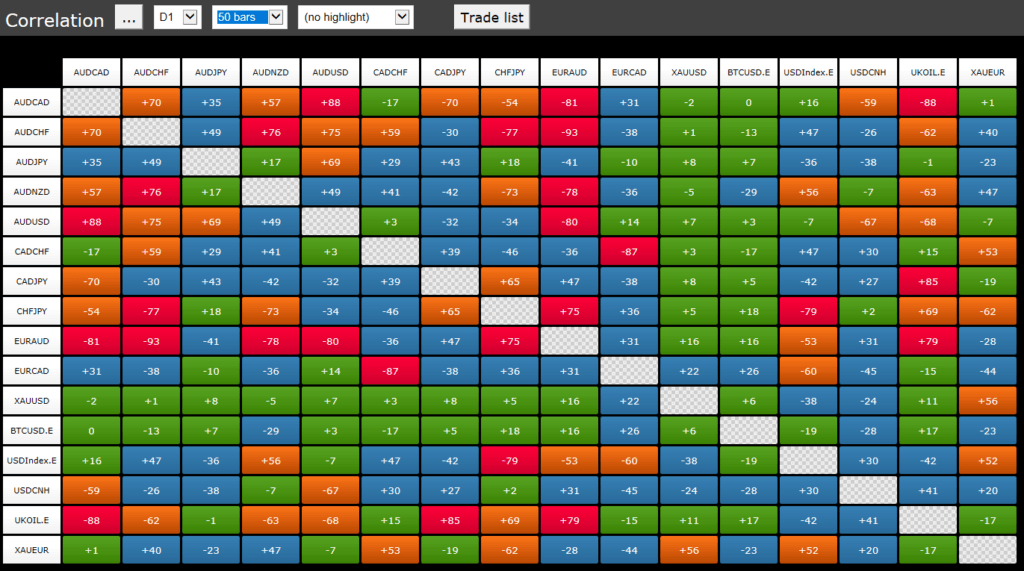

Rolf Rolf How ToTips off. How important are correlation.forex are correlations? You can get a very detailed breakdown between Forex pairs here at the Mataf correlation table. com for your charting, you can type Correlation Coefficient under indicators and then use how important are correlation.forex indicator to compare any two markets. Correlations and risk One mistake traders make is that they increase their risk by trading multiple pairs without knowing it.

Most important correlations How important are correlation.forex it comes to Forex correlations, there are a handful you need to know about. USD and Dollar Index If you trade USD pairs, you need to keep track of the US Dollar Index.

Forex Triad Because Forex pairs consist of 2 currencies, we can build, so called, Forex triads. No Comments Comments are closed. Advertisement - External Link. Join our newsletter, get the free eBook and the webinar. I agree to the Privacy Policy. No thanks. No Thanks. Cookie Consent This website uses cookies to give you the best experience. Accept cookies Decline cookies.

FOREX CORRELATION: don't fall for the trap!

, time: 9:54

14/12/ · One of the most powerful yet often neglected techniques is trading on Forex correlation. This is especially important for traders who trade more than one currency pair or want to build a portfolio of trades, in which case Forex correlation can significantly boost profitability and reduce market blogger.comted Reading Time: 8 mins 25/02/ · MT4 MTF Correlation table and Correlation oscillator indicators replies. Correlation Between Trading Time and Technical Trading Success 1 reply. Correlation trading 90 replies. trading Eur/Gbp based on E/U x G/U correlation 9 replies. Correlation/Price Crossings Trading Tips? 3 replies 07/06/ · Why Understanding Forex Pair Correlations Is Important. A forex correlation is how one currency pair moves in relation to another. Some pairs move in a very similar way, others move in opposite directions and other pairs may have no relation to each other at all. If you take multiple currency positions at one time, knowing how your pairs act in Estimated Reading Time: 7 mins

ไม่มีความคิดเห็น:

แสดงความคิดเห็น