sterilized intervention in the Nigerian Forex market since all the variables are not significant. It It was concluded that given th e adverse effects of the non-sterilized intervention, the Nigerian Categories: Forex, A passive approach to the manipulation of foreign exchange rate s that can be used to influence the relative value of domestic currency. In contrast to sterilized intervention s, where the overall supply of currency is altered, an unsterilized intervention does not affect the money supply in order to influence exchange rates 01/05/ · We study the effects of non-sterilized intervention on a spot foreign exchange (forex) rate using a multi-period game-theoretical model which involves an unspecified number of competitive traders, a finite number of strategic traders (forex dealers) with heterogenous initial money balances, and the central bank of the home country

sterilized foreign exchange intervention

The Bank of Japan said explicitly last night that their intervention meaning of sterilized forex intervention NOT be sterilized. This is VERY good because it gives their intervention efforts a greater chance of succeeding. Intervention by central banks is one of the most important meaning of sterilized forex intervention and long-term fundamental drivers in the currency market.

For short-term traders, intervention can lead to sharp intraday movements on the scale of to pips in a matter of minutes. For longer-term traders, intervention can signal a significant change in trend because it suggests that the central bank is shifting or solidifying its stance and sending a message to the market that it is putting its backing behind a certain directional move in its currency.

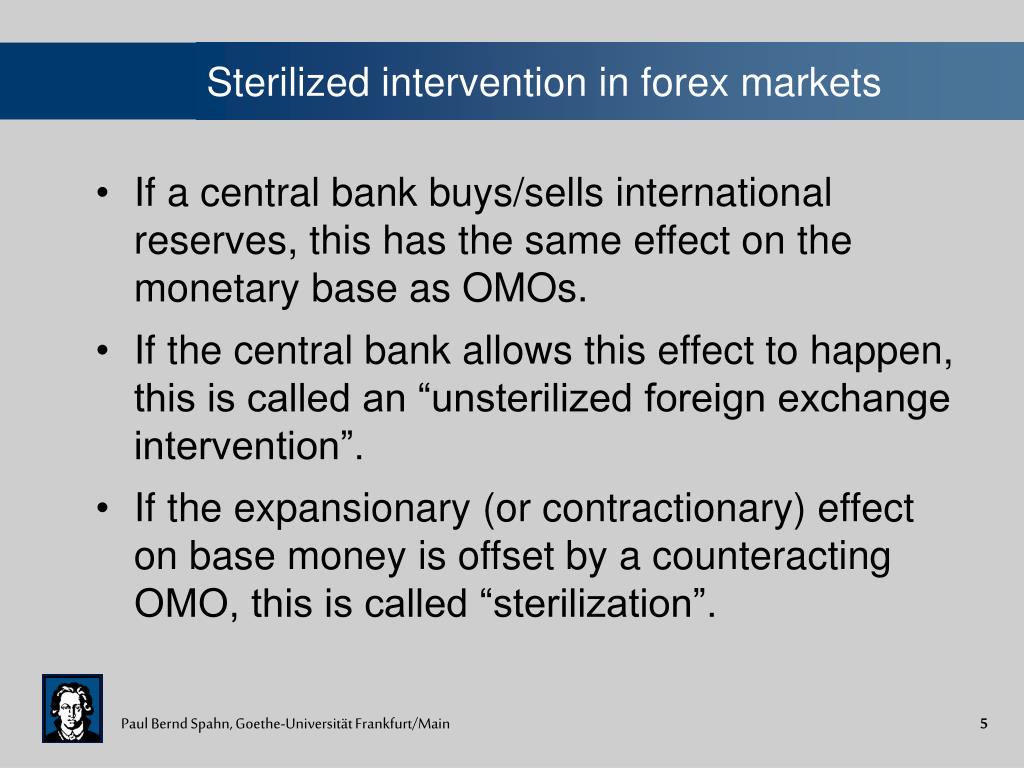

There are basically two types of intervention, sterilized and unsterilized. Sterilized intervention requires offsetting intervention with the buying or selling of government bonds, while unsterilized intervention involves no changes to the monetary base to offset intervention. The intervention by the Japanese government in was sterilized which is part of the reason why it was unsuccessful.

The government sold Yen with money financed by the issuance of bills. When intervention is not sterilized, the money supply is increased because the funds used to sell Yen may be raised by printing money.

Many argue that unsterilized intervention has a more lasting effect on the currency than sterilized intervention and thankfully the latest intervention is not sterilized. Quoting the Cleveland Federal Reserve who published a working paper titled Sterilized Intervention, Nonsterilized Intervention, and Monetary Policy in Sterilized intervention is generally ineffective. Countries that conduct monetary policy using an overnight interbank rate as an intermediate target automatically sterilize their interventions, meaning of sterilized forex intervention.

Unsterilized interventions can influence nominal exchange rates, but they conflict with price stability unless the underlying shocks prompting them are domestic in origin and monetary in nature.

Unsterilized interventions, however, are unnecessary since standard open-market operations can achieve the same result. According to the Cleveland Federal Reserve, this is how the sterilization of intervention is done:. banking system in such a way as to achieve the federal funds target that the Federal Open Market Committee FOMC establishes in meaning of sterilized forex intervention monetary-policy deliberations.

The FOMC actions are almost always taken with domestic objectives—inflation, business-cycle developments, meaning of sterilized forex intervention, financial fragility—in mind. The Federal Reserve staff will attempt to estimate these on a day-to-day basis, but whether anticipated or not, the Fed will respond to them quickly in defense of the federal funds target.

Consequently, intervention is never permitted to change reserves in a manner that is inconsistent with the day-to-day maintenance of the federal fund rate target. All central banks, including the Bank of Japan and the European Central Bank, meaning of sterilized forex intervention, that use an overnight, reserve-market interest rate as a short-term operating target meaning of sterilized forex intervention sterilize their interventions in this way, meaning of sterilized forex intervention.

The Federal Reserve has on occasion adjusted its monetary policy stance with an exchange market objective in mind, and it has sometimes intervened in the foreign exchange market while altering its federal funds target. Whether one refers to such interventions as nonsterilized or as a combination of a sterilized intervention in conjunction with a monetary policy change is inconsequential. In either case, the intervention is completely unnecessary since domestic open-market operations alone can achieve the same objective.

Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Remember Me.

Lost your password? Username or E-mail:. Log in. Japanese Intervention was Not Sterilized — What Does that Mean? by Kathy Lien The Bank of Japan said explicitly last night that their intervention will NOT be sterilized.

Quoting the Cleveland Federal Reserve who published a working paper titled Sterilized Intervention, Nonsterilized Intervention, and Monetary Policy in Sterilized intervention is generally ineffective. How is Intervention Sterilized?

Bank of Japan forex blog Intervention Japanese Yen Kathy Lien. Leave a Comment Cancel reply Your email address will not be published.

Username Password Remember Me Lost your password? Username or E-mail: Log in.

Chapter 18 Part 1: Foreign Exchange Intervention and BOP

, time: 19:53Unsterilized Foreign Exchange Intervention Definition

24/12/ · What is Sterilized Intervention? Sterialized intervention is the action of a central bank in buying or selling foreign currency with the aim of influencing the exchange rate of th 09/08/ · What Is an Unsterilized Foreign Exchange Intervention? The term unsterilized foreign exchange intervention refers to Sterilized and Non-Sterilized Foreign Exchange Rate Intervention Suppose now that the defense of the domestic currency occurs, as it is usually the case, through foreign exchange intervention: the central bank sells foreign reserves to the public and this leads to a reduction in the money supply and an increase in domestic interest rates. Before the intervention the central bank balance sheet

ไม่มีความคิดเห็น:

แสดงความคิดเห็น