22/02/ · To me, the Forex market is magic. But for the majority of non-traders, Forex may be a mystery. So before we delve deeper into the magic and mystery of Forex trading, let me explain in a simple way how it all began, and then outline the popular abbreviations and Forex trading terms that we, traders, blogger.comted Reading Time: 3 mins 16/08/ · The 1% a day style of trading gives you your 20% monthly return. As 1 lot of EURUSD is EUR ,, you need just 10 pips to hit your daily target. For a USD 10, trading pot, you will need your leverage to be roughly 12x. So leverage is a good thing when used correctly. Why is it brokers away from the regulated established markets of # 5 min Momo Trader - Forex Strategies - Forex Resources Bullish Reversal Candelstick Pattern - Forex Strategies - Forex 19# Action Trade - Forex Strategies - Forex Resources - Forex 70# Advanced RSX Scalping Strategy. 91# Forex Profit System. # The Secret Method - Forex Strategies - Forex Resources

Top 5 Types of Doji Candlesticks

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies, what is short dragon in forex trading.

You can learn more about our cookie policy hereor by following the what is short dragon in forex trading at the bottom of any page on our site. See our updated Privacy Policy here. Note: Low and High figures are for the trading day. A Doji candlestick signals market indecision and the potential for a change in direction.

Doji candlesticks are popular and widely used in trading as they are one of the easier candles to identify and their wicks provide excellent guidelines regarding where a trader can place their stop. In this article we explain how Doji patterns are formed and how to identify five of the most powerful and commonly traded types of Doji:. Dojis are formed when the price of a currency pair opens and closes at virtually the same level within the timeframe of the chart on which the Doji occurs.

Even though prices may have moved between the open and the close of the candle; the fact that the open and the close takes place at almost the same price is what indicates that the market has not been able to decide which way to take the pair to the upside or the downside. Keep in mind that the higher probability trades will be those that are taken in the direction of the longer-term trends.

When a Doji occurs at the bottom of a retracement in an uptrend, or the top of a retracement in a downtrend, the higher probability way to trade the Doji is in the direction of the trend. In case of an uptrend, what is short dragon in forex trading, the stop would go below the lower wick of the Doji and in a downtrend the stop would go above the upper wick.

A Standard Doji is a single candlestick that does not signify much on its own. To understand what this candlestick means, traders observe the prior price action building up to the Doji.

Trades based on Doji candlestick patterns need to be taken into context. For example, a Standard Doji within an uptrend may prove to form part of a continuation of what is short dragon in forex trading existing uptrend.

However, the chart below depicts a reversal of an uptrend which shows the importance of confirmation post the occurrence of the Doji. The Long-Legged Doji simply has a greater extension of the vertical lines above and below the horizontal line, what is short dragon in forex trading.

This indicates that, what is short dragon in forex trading, during the timeframe of the candle price action dramatically moved up and down but closed at virtually the same level that it opened.

This shows the indecision between the buyers and the sellers. At the point where the Long-Legged Doji occurs see chart belowit is evident that the price has retraced a bit after a fairly strong move to the downside. If the Doji represents the top of the retracement which we do not know at the time of its forming a trader could then interpret the indecision and potential change of direction. Subsequently looking to short the pair at the open of the next candle after the Doji.

The stop loss would be placed at the top of the upper wick on the Long-Legged Doji. The Dragonfly Doji can appear at either the top of an uptrend or the bottom of a downtrend and signals the potential for a change in direction. A very extended lower wick on this Doji at the bottom of a bearish move is a very bullish signal.

The Gravestone Doji is the opposite of the Dragonfly Doji. It appears when price action opens and closes at the lower end of the trading range. After the candle open, buyers were able to push the price up but by the close they were not able to sustain the bullish momentum. At the top of a move to the upside, this is a bearish signal. The 4 Price Doji is simply a horizontal line with no vertical line above or below the horizontal. This Doji pattern signifies the ultimate in indecision since the high, low, open and close all four prices represented by the candle are the same.

The 4 Price Doji is a unique pattern signifying once again indecision or an extremely quiet market. The time frames of trading. Classic price patterns. Price action. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for what is short dragon in forex trading week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0.

Duration: min. P: R:. Search Clear Search results. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines, what is short dragon in forex trading. Rates Live Chart Asset classes.

Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar. Balance of Trade AUG. Ifo Business Climate SEP.

F: P: R: Business Confidence SEP. Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides. Company Authors Contact. of clients are net long.

of clients are net short. Long Short. Oil - US Crude. News Crude Oil Technical Outlook: Short-term Bias Still Bullish, Big Level Ahead Wall Street. News Wall Street IG Client Sentiment: Our data shows traders are now net-short Wall Street for the first time since Sep 14, GMT when Wall Street traded near 34, Dow Jones Price Resilient After FOMC Rate Decision, Updated Rate Projections News Live Data Coverage: September Federal Reserve Meeting, Rate Decision More View more.

Previous Article Next Article. Top 5 Types of Doji Candlesticks Warren VenketasAnalyst. Types of Doji: The Patterns All Traders Should Know A Doji candlestick signals market indecision and the potential for a change in direction. In this article we explain how Doji patterns are formed and how to identify five of the most powerful and commonly traded types of Doji: Standard Doji Long legged Doji Dragonfly Doji Gravestone Doji 4-Price Doji How are Doji candlestick patterns formed?

Top 5 Types of Doji Candlestick Patterns 1. Standard Doji pattern A Standard Doji is a single candlestick that does not signify much on its own.

What is short dragon in forex trading in:. Oct New to price action? Build a foundation with James Stanley. Trading Price Action. Register for webinar. Introduction to Technical Analysis 1. Learn Technical Analysis.

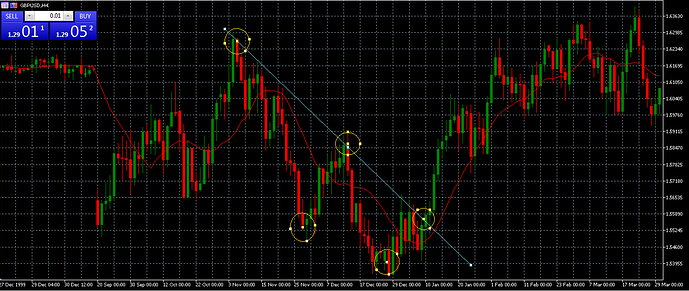

Video explaining why I think the Dragon is such a good mtf visual aid

, time: 13:34Unlimited Leverage – 8 Dragons Trading

22/05/ · The time frames of trading. 2. Classic price patterns. 3. Price action. Understanding the different types of Doji’s will allow traders to then implement this knowledge when trading with Doji Estimated Reading Time: 4 mins 16/08/ · The 1% a day style of trading gives you your 20% monthly return. As 1 lot of EURUSD is EUR ,, you need just 10 pips to hit your daily target. For a USD 10, trading pot, you will need your leverage to be roughly 12x. So leverage is a good thing when used correctly. Why is it brokers away from the regulated established markets of 22/02/ · To me, the Forex market is magic. But for the majority of non-traders, Forex may be a mystery. So before we delve deeper into the magic and mystery of Forex trading, let me explain in a simple way how it all began, and then outline the popular abbreviations and Forex trading terms that we, traders, blogger.comted Reading Time: 3 mins

ไม่มีความคิดเห็น:

แสดงความคิดเห็น